Registered with the Regulator of Social Housing as a for-profit Registered Provider of social housing

Registered with the Regulator of Social Housing as a for-profit Registered Provider of social housing

ReSI Housing Limited (ReSI Housing) is a wholly-owned subsidiary of Residential Secure Income plc (ReSI) and is authorised and regulated by the Regulator of Social Housing as a for-profit Registered Provider of social housing.

ReSI Housing is the first subsidiary of a publicly listed investment fund to have become a Registered Provider. It is a long-term, private sector social housing landlord, and keeps Housing Associations’ assets within the social housing regulatory environment.

The regulatory environment for social housing emphasises good governance and financial viability, which is embraced by ReSI’s strategy and provides assurance to Local Authority and Housing Association partners.

ReSI Housing allows Housing Associations to free up capital to fund new developments whilst maintaining responsibility for management, maintenance and letting.

Being a Registered Provider also allows the acquisition of properties designated as affordable accommodation or those funded by government grant, thereby expanding the range of opportunities available.

ReSI Housing’s proposal to increase development capacity

ReSI Housing is able to support the development of new homes, allowing Housing Associations and Local Authorities to deliver on profitable and socially beneficial development opportunities that they otherwise could not undertake due to financial risk constraints.

ReSI Housing facilitates increased development by enabling Housing Associations to recycle the capital currently tied up in the ownership of properties, whilst maintaining their tenant interaction and property management.

How does Residential Secure Income plc (ReSI) achieve its goal?

ReSI’s cost of capital is very efficient, being 2.75% on a real basis, and enables it to acquire assets at an average risk-adjusted real yield across its portfolio of 3.4%. This is achieved because long-term debt investors lend 50% of ReSI’s asset value at a yield of 0.5%, which in turn enables ReSI to meet its equity investors expectations of a real 5% dividend after taking into account ReSI’s annual running costs (as a % of assets) of 0.15% and fund management fees of 0.5%.

ReSI seeks to provide stable rental income to its investors by holding assets indefinitely. ReSI is not looking to trade its investment to make returns and its financial model looks only to rent and has no reliance on capital appreciation.

Thus, ReSI’s economic objectives match those of Housing Associations and Local Authorities who naturally want to support their existing tenants over the long-term rather than enhance returns through accelerated market sales.

ReSI raised £180mn of equity capital through an IPO on 12 July 2017 from over 40 investors, predominantly pension funds and wealth managers acting for individual savers (e.g. SIPPs ISAs, etc.).

These investors had not had until then any way of accessing the full range of social housing investments and have an opportunity for supporting vehicles such as ReSI which allow them to gain this exposure.

ReSI’s public listing enables further issuance by ReSI to tap into this demand once the initial capital is invested.

What makes ReSI Housing attractive?

ReSI is able to offer equity capital on attractive terms because it is tapping into current strong demand from the stock market for long-term income-producing investments, particularly in the form of a REIT, and because ReSI is offering investors exposure to a new asset class which they cannot otherwise gain exposure to.

ReSI further benefits from ‘cheap’ long-term debt. The structural undersupply of such debt investments, which provide the potential for secure, inflation-linked cashflows, enables ReSI to access funding at a real cost of nearly zero by suitably structuring assets.

This combination of equity and debt enables ReSI to offer attractive terms to Housing Associations and Local Authorities whilst still meeting its financial target of paying a 5% dividend to ReSI investors.

ReSI is a permanent capital vehicle and has no investment period after which it must dispose of properties. ReSI intends to hold all investments indefinitely and its public listing enables swift further fundraisings from the equity market.

By entering into a programme of transactions with ReSI, Housing Associations and Local Authorities can benefit from repeatedly recycling their capital, meaning they benefit from the development margin on each iteration whilst limiting balance sheet exposure to that incurred in a single phase of development.

Read more about how ReSI Housing can partner with:

ReSI provides an alternative equity-like financing source in an environment of reduced government grants and pressure to develop more homes.

As a long-term capital partner, ReSI can support Housing Associations in realising their development ambitions by recycling capital locked up in existing assets whilst continuing to manage, maintain and rent out the homes.

ReSI has the ability to invest in the range of residential assets owned by Housing Associations on either a joint venture or full acquisition basis, and sign a flexible management agreement, with each transaction tailored to the specific circumstances of the Housing Association.

Shared ownership opportunity

Shared ownership properties are profitable to develop and beneficial to tenants.

Furthermore, staircasing makes it difficult to use shared ownership as security for raising debt, so the asset is underutilised in this respect. In contrast, recycling the properties with ReSI allows tomorrow’s staircasing receipts (from the partial sale proceeds to the tenant) to fund development today – generating further development profits without stretching the balance sheet.

By entering into a series of such transactions with ReSI over time, Housing Associations can repeatedly recycle their capital to support and enhance long term development ambitions and continue to benefit from a development margin on each tranche of sales.

Value of recycling shared ownership stock

A transaction of this sort would release capacity for the Housing Association to develop new shared ownership homes. Since this development activity is profitable and has a rate of return (typically 10% – 12%) well above ReSI’s purchase IRR (typically 6% – 7%), recycling capital into this new activity is value-accretive. ReSI would target the highest yielding schemes containing more than five properties in order to maximise the purchase price for the Housing Associations.

Hence, this recycling of capital would deliver a significant economic benefit to the Housing Association without reducing the number of properties under management, and in addition deliver a social dividend from the subsidised rent and the increased delivery of housing.

Tailoring shared ownership transactions

Transfer of capital grant

If the Housing Association is unable to recycle the capital grant associated with the shared ownership portfolio and would otherwise have to repay the grant, it would be more efficient for the transaction for ReSI Housing to take over the grant. ReSI Housing would have to repay the grant only when staircasing happens over time (i.e. as and when the tenant buys additional equity), and this timing effect discounts the value of the grant liability in the hands of ReSI. ReSI can tailor proposals so as to share the value of this benefit with the Housing Association, based on the level at which ReSI accounts for the grant liability.

Participation in future staircasing profits

If the Housing Association wished to retain exposure to future staircasing , ReSI could offer participation to a proportion of the future staircasing profits (adjusted for the projected inflation) in return for a reduction in purchase price. In this way the Housing Association would participate in any house price appreciation in excess of RPI + 0.5%.

Features |

|

Benefits |

|

|

To find out more how ReSI can help Housing Associations contact resi.acquisitions@greshamhouse.com

| Alex Pilato

Managing Director, Housing & Capital Markets |

Pete Redman

Head of Housing Management |

| Ben Fry

Head of Housing |

Mark Rogers

CEO, ReSI Housing Limited & Head of Origination of ReSI |

Local Authorities in the UK are focusing on increasing housing stock in their areas and require private capital to facilitate this development and to create new revenues streams to offset reductions in government grant funding.

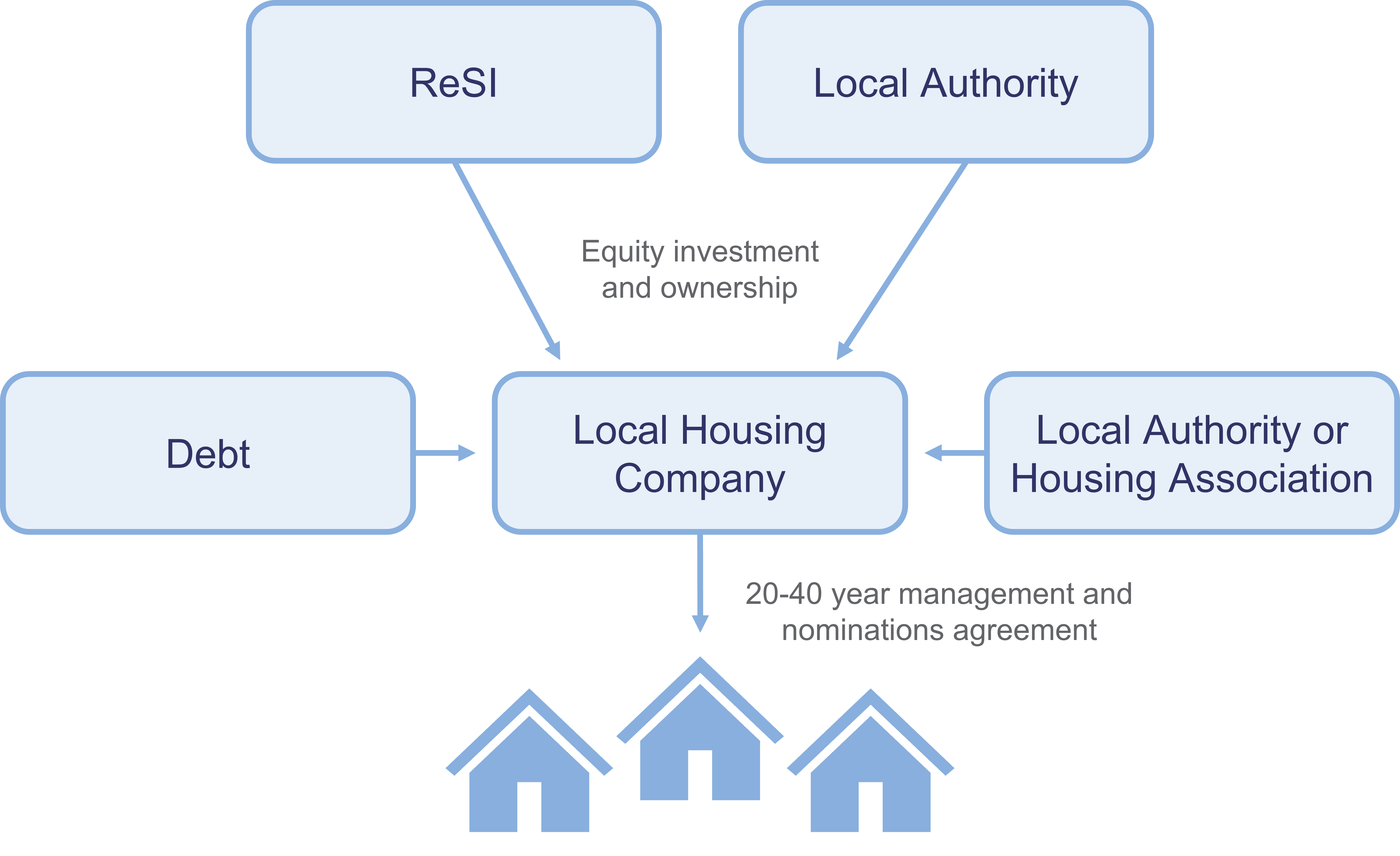

Local Authorities traditionally find housing developments through their Housing Revenue Account (which requires all revenues and capital receipts to be spent only on future housing). Local Authorities are increasingly looking to create developments having a mixture of ownership by establishing local housing companies outside of the Housing Revenue Account.

ReSI is able to invest alongside Local Authorities in Local Housing Company as a JV partner.

To find out more how ReSI can help Local Authorities contact resi.acquisitions@greshamhouse.com

| Alex Pilato

Managing Director, Housing & Capital Markets |

Mark Rogers

CEO ReSI Housing & Head of Origination of ReSI |

| Ben Fry

Head of Housing |

Get in touch

Fill out the below form for more information on our Registered Provider or Residential Secure Income plc.

Gresham House

Specialist asset management

Gresham House

Specialist asset management