As asset allocation to alternatives continues to increase, investors need a specialist to show them the right path.

As asset allocation to alternatives continues to increase, investors need a specialist to show them the right path.

Leading the shift to alternatives

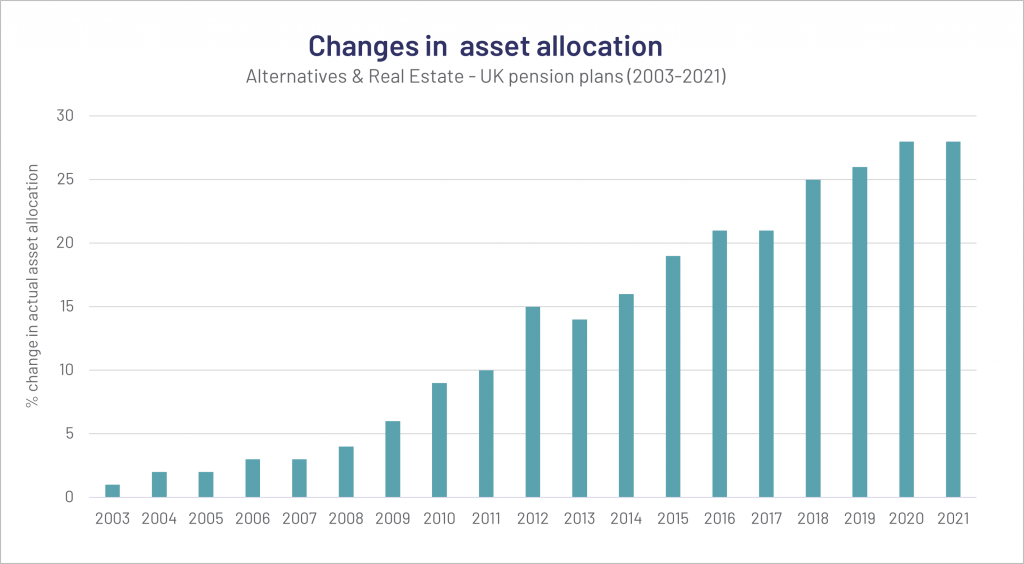

In an effort to diversify from traditional mainstream assets, investors have been steadily increasing their allocation to alternative asset classes for more than a decade.

As a specialist alternative asset manager, Gresham House is well positioned to help individuals, families and institutions access these asset classes and deliver the potential for superior returns alongside proactive management of environmental, social and governance (ESG) considerations.

Why invest?

Our investment team has extensive experience in a range of alternative asset classes.

We have invested considerable time in developing robust investment processes, proprietary origination networks and best-in-class asset management capability for all our strategies.

There is strong appetite for alternative investments from investors across the spectrum, notably private, uncorrelated investments.

These assets offer the potential for superior returns when compared with traditional asset classes.

Source: Mercer European Asset Allocation Survey 2021

How to invest in our alternative assets

We offer a number of alternative investment opportunities for a range of investors.

Gresham House

Specialist asset management

Gresham House

Specialist asset management