The next frontier: investing in natural capital and preserving biodiversity

The next frontier: investing in natural capital and preserving biodiversity

At Gresham House, we believe that natural capital will emerge as a major global investment trend in the coming years.

Natural capital is defined by the Natural Capital Coalition as the stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people.

- Renewable natural resources can regrow or renew, such as plants, animals, air and water

- Non-renewable natural resources are finite and non-living, such as fossil fuels, soils and minerals

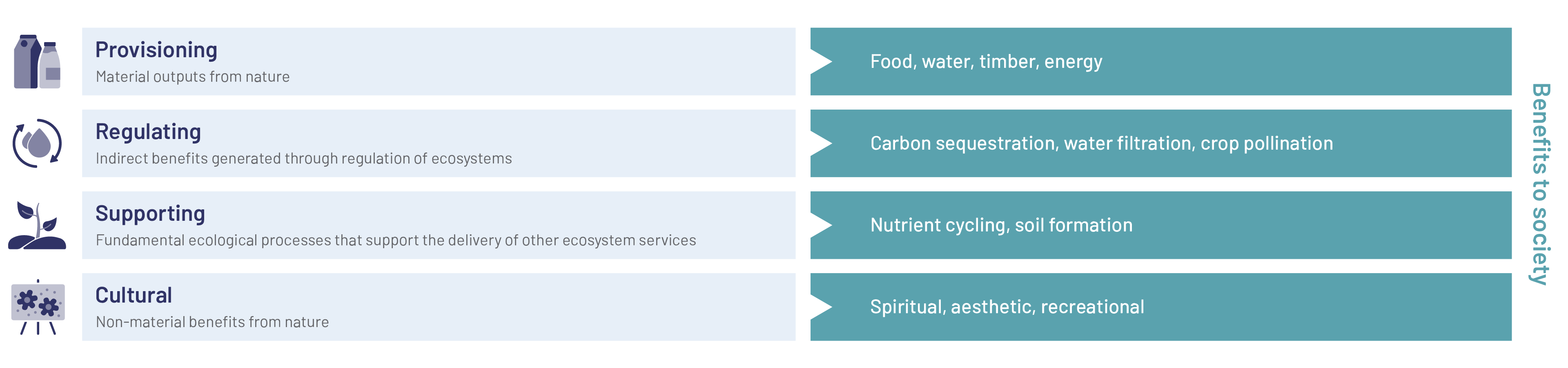

Nature delivers benefits to society through the provision of four core ecosystem services:

Some of these benefits to society have been valued via well-established markets for decades, including energy, food, and timber.

Now, as a result of recent market innovations, investors have the potential to generate value from investments that target some of the other benefits that flow from nature to society.

An example of this is the sale and purchase of carbon credits, which has created a new market and places a monetary value on carbon sequestration, a regulating ecosystem service.

Why is natural capital so important?

The UN Environment Programme estimates that half the world’s GDP is dependent on nature.

However, we are using our natural resources at a pace beyond that which the earth can replenish.

Wildlife populations have declined by 69% since 19701, more than 85% of wetlands have been lost and 32% of the world’s forest area has been destroyed.2

Beginning to recognise nature as a form of capital means that we can better value the benefits it offers our societies and economies and therefore aim to protect and restore it.

The world’s natural capital is estimated to be worth $125tn (1.25x Global GDP in 2022)3

Biodiversity loss is an existential threat to human life on earth.

Biodiversity is defined as the variability among living organisms from all sources, including terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species and of ecosystems (UN 1992).

It is an essential characteristic of nature and is critical to maintaining the quality, resilience, and quantity of ecosystems and the provision of ecosystem services on which business and society rely.4

Biodiversity and nature-positive solutions are an increasing focus for investors wanting to effect change whilst also generating the potential for robust financial returns.

The investment opportunity

While many investors have exposure to natural capital through assets like renewable energy (a provisioning ecosystem service) and have grasped the importance of investing in carbon related investments, other forms of natural capital, including biodiversity, remain an enigma – both from a product and return perspective.

Despite increased visibility and interest in the market, very few investors have active portfolio allocations to natural capital which contribute positively to the restoration or protection of nature.

Our recent Impact Lens research paper in association with Pensions for Purpose, Natural capital and biodiversity - where are UK asset owners on their journey? found that just 38% of those interviewed were already invested in natural capital solutions5.

Investing for our futures: Every $1 invested in restoration creates up to $30 in economic benefits6

At Gresham House, we have been investing in natural capital for many years, seen through our multi-decade track record in Forestry.

These assets produce timber which is a provisioning ecosystem service, and contribute to carbon sequestration, a regulating ecosystem service.

We are currently expanding our capability to report on the biodiversity within our forests and included initial analysis in our most recent Sustainable Investment Report.

We are also focused on developing new, interlinked solutions across real assets such as forestry and sustainable infrastructure – including carbon forestry, vertical farming, biodiversity net gain credits and habitat banks – as innovative ways to promote the potential transition towards a more sustainable economy through the protection and restoration of nature.

It is important to note that not all natural capital investments will contribute to the protection and restoration of nature. Other natural capital investments may seek to harness the benefits that nature provides society in a sustainable manner, such as productive forestry which generates timber.

Measuring and comparing the value of different benefits to people from nature is complex.

We help investors select natural capital investments based on the outcomes they want their portfolio to contribute towards within the context of their financial objectives.

Get in touch for more information or find out more about the relevant asset classes below.

Heather Fleming

Managing Director, Institutional Business

Capital at risk. Forestry investment is not for everyone. Please read more about the investment class and read up on the risks involved before considering investing.

References

1. WWF, 2021

2. WEF New Nature Economy Report, 2020

3. Institute and Faculty of Actuaries, Natural Capital – an actuarial perspective, 26 April 2021

4. Taskforce for Nature Related Financial Disclosures

5. Within the context of the report, “natural capital solutions” were investments explicitly targeting nature-positive outcomes

6. UN environment programme, Beyond GDP, February 2022

Gresham House

Specialist asset management

Gresham House

Specialist asset management